Supporting the Local Entrepreneurial Ecosystem. Entrepreneurship Tax Credits Make Economic Sense with Targeted Delivery.

Emporia Main Street acts as a partner with a statewide group called Network Kansas. The Network Kansas group helps connect businesses in Lyon County with resources like training, loans, network connections, and more. Currently, Emporia Main Street manages over twenty loans for local business expansions or startups through the Network Kansas Lyon County E-Community, and several local businesses have benefited through destination business training and other entrepreneurial support initiatives. Those support initiatives are funded through a very specific statewide donation portal known as the Kansas Center for Entrepreneurship Tax Credit.

Background

Kansas Center for Entrepreneurship d.b.a. NetWork Kansas was created as a key component of the Kansas Economic Growth Act of 2004 to lead collaborative efforts between education, research and outreach services—as well as public sector organizations—in order to serve potential and existing entrepreneurs statewide. An integral part of this effort is providing seed capital to entrepreneurs and small business owners in rural and distressed areas of Kansas. The Kansas Center for Entrepreneurship Tax Credit was created to stimulate this effort.

75% Tax Credit

Donors receive a 75% state income tax credit for their donation. A tax credit is a dollar-for-dollar credit against state income tax liability. This means thatfor every $1,000 donated, donors will receive $750 credit directly off of their state income tax liability.

Donors are also eligible to receive a federal and state tax deduction and should consult with their individual tax specialist to determine the amount ofany deductions. A K-31 Form is required with the individual tax form and is available online through the Kansas Department of Revenue.

What are the Individual Minimum and Maximum Annual Tax Credits Allowed?

The minimum allowable tax credit per year is $187.50, which translates into a donation of $250. The maximum allowable credit per year is $100,000, which translates into a donation of $133,333.33. If the amount of the tax credit exceeds the contributor’s liability in the taxable year, the remaining portion of the credit may be carried forward until the total amount of credit is applied.

Who Can Donate?

Individuals, financial institutions* (banks and savings and loans), and corporations** can donate to the Kansas Center for Entrepreneurship.

Where Does the Money Go?

Donations to the Center provide funding for entrepreneurship programs and matching loans through local or regional non-profit business support providers who are also NetWork Kansas resource partners.

Entrepreneurship programs and matching loans are made available to businesses who are starting or expanding a business.

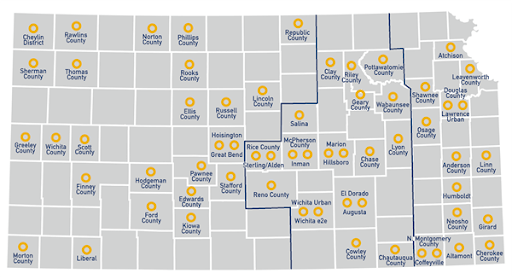

NetWork Kansas resource partners include the Entrepreneurship Community Partnership, economic development agencies, small business development centers, and other non-profit organizations charged with assisting entrepreneurs and small businesses in Kansas.

How Do I Donate to the Fund?

Make checks payable to the Kansas Center for Entrepreneurship. The mailing address is:

Kansas Center for Entrepreneurshipc/o NetWork KansasP.O. Box 877Andover, Kansas 67002-0877

The donor will be required to provide their social security number or company federal tax identification number to the Kansas Center for Entrepreneurship in order to receive credit for their donation.

How Do I Contact Network Kansas?

If you have questions about the Kansas Entrepreneurship Tax Credit, please contact:

Kristi Pedersen316.425.8808 | [email protected]

For more information about NetWork Kansas, please call 877.521.8600 to speak with one of the referral coordinators or visit the Network Kansas website: www.networkkansas.com